The daily fair market rental value is calculated as follows: How do I determine the timeshare unit’s fair market rental value? I am a timeshare interval owner and pay $700 annually in maintenance fees. The taxpayer shall use gross daily maintenance fees, unless the taxpayer proves or the Director of Taxation determines that the gross daily maintenance fees do not fairly represent fair market rental value taking into account comparable transient accommodation rentals or by other appraisal methods. What is fair market rental value?įair market rental value is defined as an amount equal to one-half the gross daily maintenance fees that are paid by the owner, are attributable to the timeshare unit and include maintenance costs, operational costs, insurance, repair costs, administrative costs, taxes, other than transient accommodations taxes and other costs including payments required for reserves or sinking funds. The transient accommodations tax on timeshare occupancy is 7.25% on the unit’s fair market rental value. The timeshare plan manager is responsible for collecting the tax, filing the tax returns and paying the tax to the Department of Taxation.Ī plan manager is a person who undertakes the duties, responsibilities and obligations of managing a resort timeshare vacation plan or is required to act for a resort timeshare vacation plan under the Transient Accommodations Tax Law. Act 156, therefore, taxes the transient occupancy of resort timeshare vacation units under the transient accommodations tax in a manner similar to hotels being taxed on their hotel rental.Īs a timeshare interval owners, am I responsible for filing the tax returns for the transient accommodations tax on timeshare occupancy? The contract price is paid or financed all at one and there is no worry about skyrocketing hotel rentals or inflation.” Transient individuals occupying a resort timeshare vacation unit utilize State and county facilities in a manner similar to transient individuals occupying hotels. Act 156 quotes the following language from The Law and Business of Time-share Resorts: “The purchaser is essentially purchasing tomorrow’s vacation at today’s prices and dollars.

The Legislature found that timeshare interval owners are similar to transient individuals occupying hotels for tax purposes. Why is the occupancy of resort timeshare vacation units being taxed? Note: the 2014 transient accommodations tax on timeshares is currently 9.25%.įollowing you will find answers to questions relating to the law from the timeshare interval owner’s perspective as copied from Tax Facts – a publication issued by the Department of Taxation, State of Hawaii. A separate retail tobacco permit for each retail location (including vehicles) is required.Transient Accommodations Tax on Timeshare OccupancyĮffective January 1, 1999, Act 156, Session Laws of Hawaii 1998, provides that the transient accommodations tax is imposed on the occupant of a timeshare unit at the rate of 7.25% of the unit’s fair market rental value.

#HAWAII TRANSIENT ACCOMMODATIONS TAX LICENSE#

Holders of a county liquor license for Manufacturer, Wholesaler, or BrewpubĪnyone who distributes cigarette or tobacco products or comes into the possession of cigarette or tobacco products that have not been acquired from another licensee or retail tobacco permit holderĬigarette and Tobacco – Retail Tobacco PermitĪnyone who sells cigarettes and tobacco products to consumers.

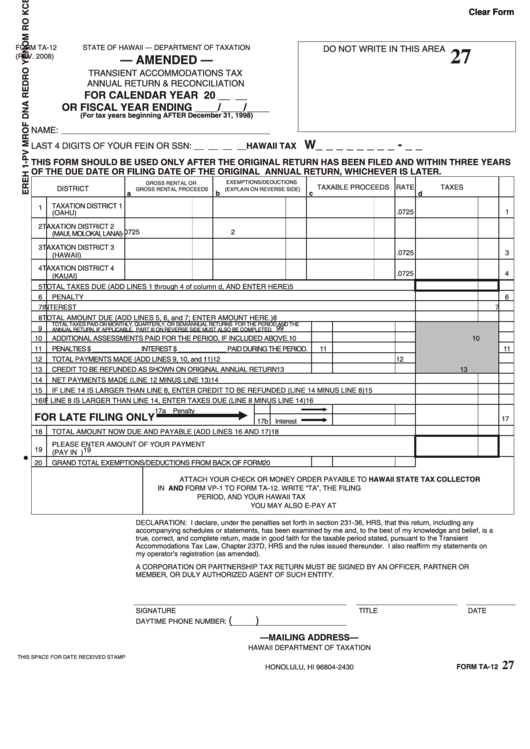

With the intention of selling or using the liquid fuel in the stateĪnyone who purchases liquid fuel from licensed distributors with the intention of selling the liquid fuel to consumers. Persons/businesses that refine, manufacture, produce, or compound liquid fuel in the state or import liquid fuel into the state. Rental Motor Vehicle, Tour Vehicle, and Car-Sharing Vehicle Certificate of RegistrationĪnyone that rents out motor and/or tour vehicles or operates a car-sharing organization. Transient accommodations brokers, travel agencies, or tour packagers who enters into arrangements to furnish transient accommodations at noncommissioned negotiated contract rates. Transient Accommodations Tax Certificate of RegistrationĪnyone who rents a transient accommodation (for example, a house, condominium, hotel room) to a transient for less than 180 consecutive days

#HAWAII TRANSIENT ACCOMMODATIONS TAX REGISTRATION#

The table below summarizes by type of license, who must register, the registration frequency, and associated fees Tax License TypeĪnyone who receives income from conducting business activities in the State of Hawaii including, but not limited to: wholesaling, retailing, farming, services, construction contracting, rental of personal or real property, business interest income, and royalties.

Businesses operating in Hawaii are required to register with the Department to obtain a license, permit, certificate registration, or exemption, (all generally referred to by the Department as a “license”).

0 kommentar(er)

0 kommentar(er)